52+ why isn't my mortgage interest deductible this year

Look in your mailbox for Form 1098. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

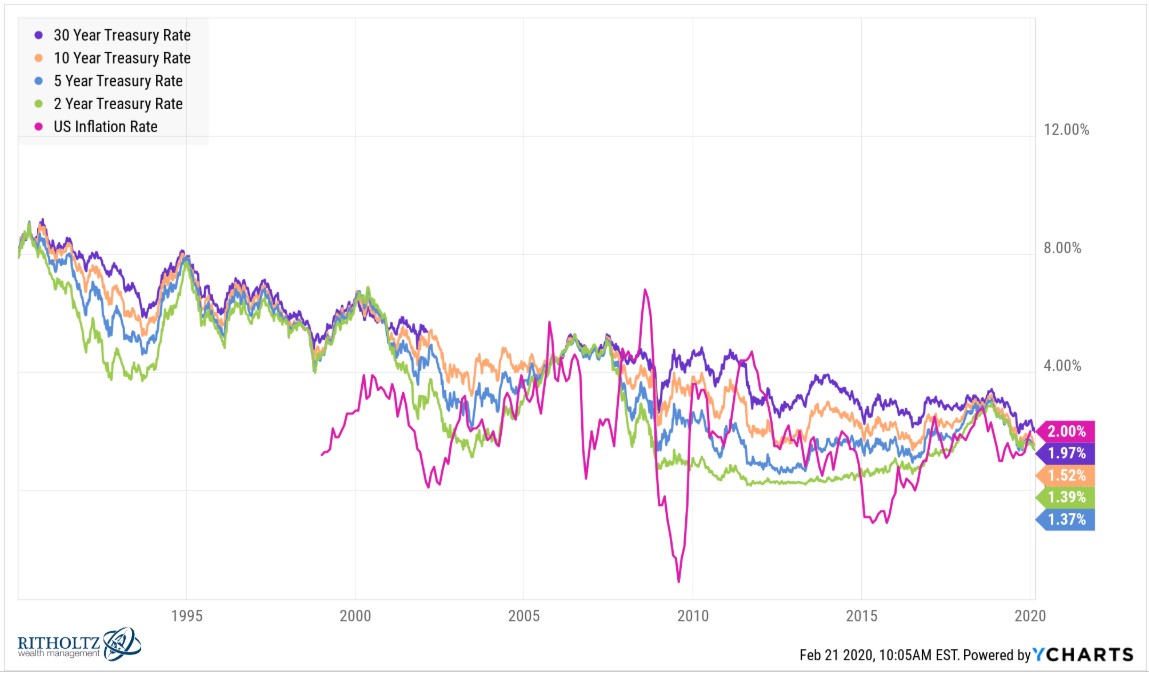

Chart Of The Day Focus On The Easy Money Smart Money Tracker

Web Up to 96 cash back A home mortgage is also called acquisition debt these are debts that are.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

. For tax years before 2018 the interest paid on up to 1 million of acquisition. Web Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. That means for the 2022 tax year married couples filing jointly single filers and heads of households could deduct the interest on.

The terms of the loan are the same as for other 20-year loans offered in your area. Web The mortgage interest deduction got a new limit One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage. Web To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have.

Web Now the loan limit is 750000. 16 2017 then its tax-deductible on. Web Up to 96 cash back On your 1098 tax form is the following information.

Web Mortgage interest will only count towards deductions if you are itemizing your deductions. Your mortgage lender sends you. You paid 4800 in.

Box 3 Mortgage origination. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Box 1 Interest paid not including points.

If you took out. TurboTax automatically calculates if you should itemized your. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Important rules and exceptions. Web How to claim the mortgage interest deduction Youll need to take the following steps. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Web For tax years prior to 2018 your mortgage interest deduction is generally limited if all mortgages used to buy construct or improve your first home and second. Box 2 Outstanding mortgage principle.

Used to buy build or improve your main or second home and Secured by that home.

Rocky Point Times August 2021 By Rocky Point Services Issuu

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Adjustments Matter Mauldin Economics

Blog Ymm Residential Market Update

Tax Tips For Photographers To Maximize Your Take Home The Photo Argus

Propertync Magazine 71 By Propertync Magazine Issuu

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

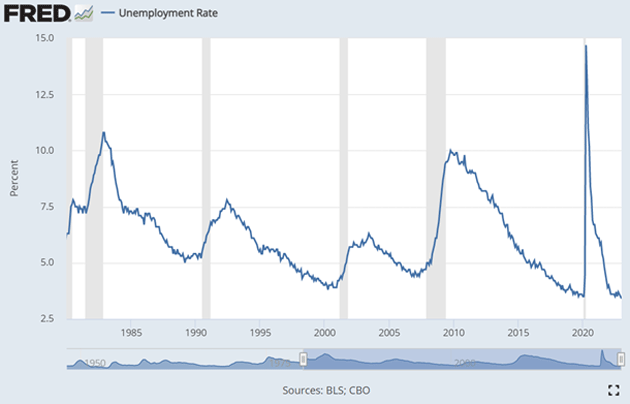

Should You Pay Off Your Mortgage Early With Rates So Low

Adjustments Matter Mauldin Economics

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Hmw Conference Proceedings 2013 By Te Kotahi Research Institute Issuu

6ix5otpfd

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Who Gets It Wsj

Understanding The Mortgage Interest Deduction With Taxslayer

Benjamin Graham Articles Magazine Of Wall Street 1917 1922 Pdf Bonds Finance Yield Finance

Mortgage Interest Deduction Rules Limits For 2023